|

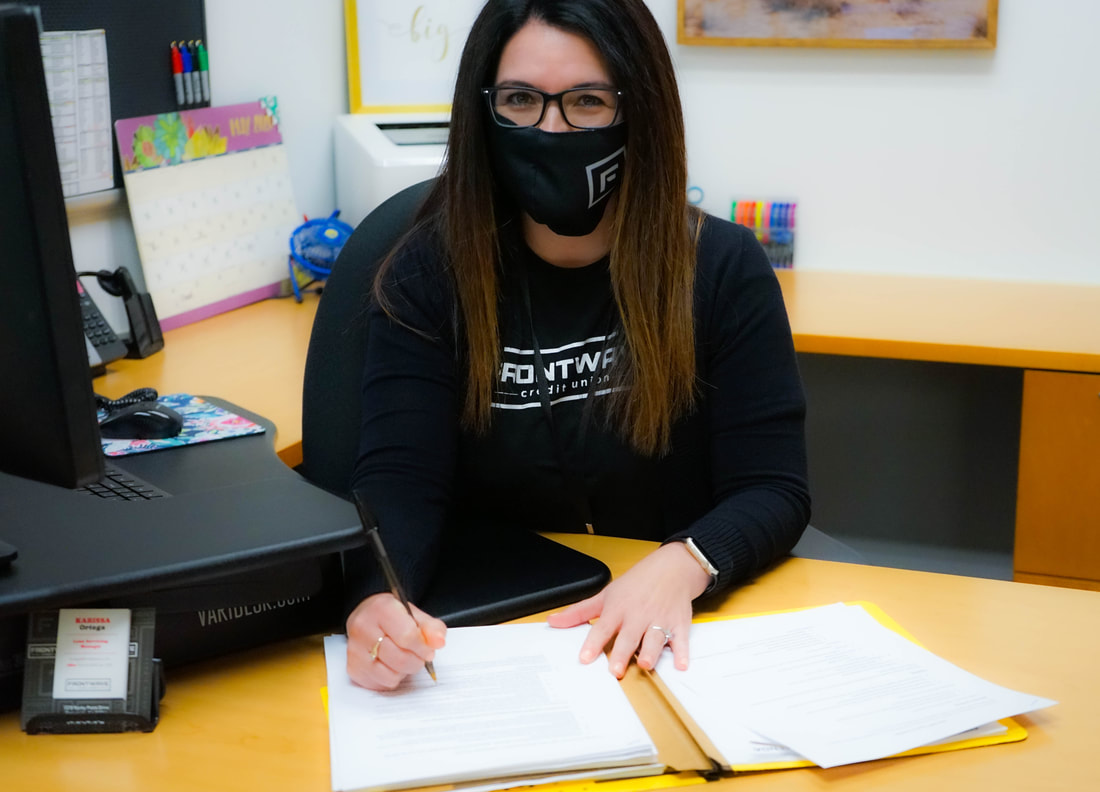

Karissa Keith, Frontwave Loan Servicing Manager, has been working diligently behind the scenes to ensure Paycheck Protection Program loans are funded as quickly as possible, enabling local businesses to fight though these challenging times. By Kristi Hawthorne Small businesses across the country are experiencing a devastating economic disruption due to the Coronavirus (COVID-19) outbreak. When Frontwave Credit Union, headquartered in Oceanside, heard from its members as well as the business community that there was a great need for Small Business Administration (SBA) loans they went into action. Frontwave applied to become eligible to originate Paycheck Protection Program loans under the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The SBA was looking for lenders that align with their values and willing to facilitate their mission with speed and effectiveness and Frontwave Credit Union was selected based on their reputation.

Todd Kern, Chief Marketing Officer of Frontwave, said that keeping “true to their name Frontwave has taken the lead and doubled down on who they are as an institution and their goal to be the best place their membership has ever banked.” Knowing that small businesses are the heart and soul of any community, Frontwave assembled a “Dream Team” to hit the frontline and assist business owners who are impacted by the shutdown. They recognize that businesses are comprised of people, individuals and families, who are hurting, because needed revenue and income streams have been eliminated. Small business owners have expressed tremendous anxiety … are they going to survive? How long can they survive? How do they digest and understand the details of an application and the loan process? Paul Leonhardt, Frontwave’s Chief Lending Officer, said “that stepping up and responding to a need falls in line” with their brand. They want to take the lead, as their name implies, taking immediate action when action is needed and doing a business with a purpose. What better cause to fight for - other than the backbone of America - small businesses? Frontwave is ready to be the “first to fight” for small businesses who employ thousands upon thousands of people in San Diego, Riverside and San Bernardino Counties. It is their mission to help to help them succeed. While the majority of the PPP applications have come from Oceanside, the applicants are from neighboring cities such as Vista and all points in between to include Temecula, as well from Yucca Valley and the surrounding desert. Frontwave mobilized a team that Paul called “dream makers” who are making financial dreams come true. After they identified and enlisted members within their organization, they assembled a team who were equipped in a variety of skills and expertise to help speed up and to help execute the loan process. Their goal is to deliver loans in a timely process. With Frontwave’s dream team deployed on the frontline, they are committed to delivering solutions so that its individual members, as well as small businesses, can survive and thrive. Financial health leads to overall healthier communities, providing need stability in uncertain times. Frontwave prides themselves on their step-by-step communication with applicants, who receive follow up phone calls, updates, and reassurance. Charlie Anderson, owner of the Privateer Coal Fire Pizza in South Oceanside shared his experience: “I never realized that small business could include credit unions until the recent PPP loan debacle made by big banks. We hedged our bets on the second round of loans because of the recommendation from the Oceanside Chamber to use Oceanside’s Frontwave Credit Union for our PPP application. The process was simple, the communication was amazing and personal, and we were personally called and congratulated on being funded within days! The team at Frontwave has earned my respect and my business, and honestly changed the way I think about banking!” Maria Mingalone, director of the Oceanside Museum Art, applied for a loan at Frontwave as well and had positive things to say. “Oceanside Museum of Art (OMA) finally prevailed in receiving the PPP loan -- thanks to Frontwave Credit Union and CEO Bill Birnie’s amazing team there! They are a spirited, community-driven bank and OMA is happy to be among their membership rolls.” Paul Leonhardt said that “consultative servicing” is a priority. He spoke of one instance when a business owner was panicked about the loan application, process and length of time it would all take. The owner was discouraged because they had not made any headway with a previous application from a different lender. Paul said they communicated over a Saturday and then into Sunday … with the result being that the loan was approved on Monday. The business owner was so relieved and grateful. Frontwave’s Dream Team had accomplished the need loan approval in 48 hours and the business owner had a loan guarantee along with a loan number…providing peace of mind. Todd Kern, says that’s exactly what Frontwave does: “Going above and beyond, striving to be a values based business with purpose driven work.” As of this writing just over $5.5 million in PPP loans had been approved through Frontwave Credit Union, assisting 157 businesses within the local communities in which they serve.

Tanya Oscar

7/8/2022 12:49:08 pm

A couple of weeks ago, I obtained a copy of my scores from the 3 credit bureaus; they were in the 579 range, how pathetic. He says there was no way I could be granted a loan with such a score so he rather introduced me to a credit specialist. In a few weeks, the specialist deleted all items on my report and raised my score to a whopping 791 across all 3 bureaus and I got my loan after 4 days, very excited. Contact: fixmycredit @ writeme dot com. Comments are closed.

|

Categories

All

Archives

December 2023

|

|

|

|

|

RSS Feed

RSS Feed