|

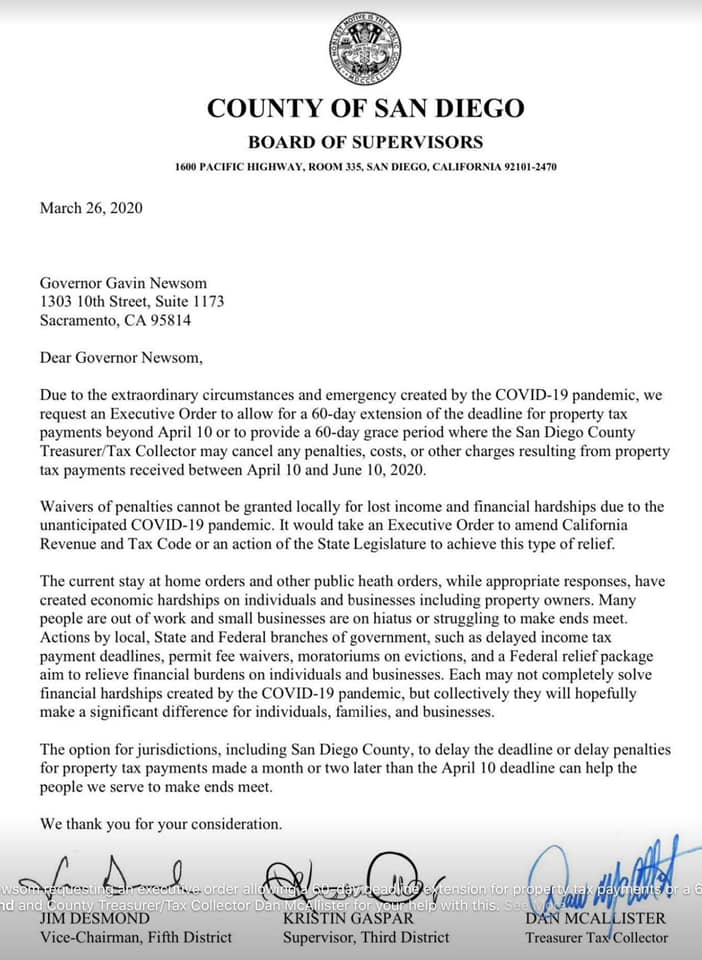

San Diego County Supervisors Jim Desmond and Kristin Gaspar, along with Treasurer-Tax Collector Dan McAllister have reached out to Governor Gavin Newsom to seek protection for residents and businesses that are unable to pay their property tax bill by the April 10th deadline.

(By: Kevin Ham)

What is a R&D Tax Credit? You may be surprised to find out that your business may qualify. The R&D tax credit started in 1981 to help stimulate the economy and to keep American jobs? WASHINGTON — The Internal Revenue Service today issued a Revenue Procedure (LINK) allowing a taxpayer to make a late election, or to revoke an election, under section 168(k) for certain property acquired by the taxpayer after September 27, 2017, and placed in service by the taxpayer during its taxable year that includes September 28, 2017.

WASHINGTON — The IRS, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create a written information security plan to protect their clients’ data.

Using a new “Taxes-Security-Together” Checklist, the Internal Revenue Service and the Security Summit partners urged tax professionals to review critical security steps to ensure they are fully protecting their computers and email as well as safeguarding sensitive taxpayer data.

Join Congressman Mike Levin for a round table discussion about the impacts of the cap on the State and Local Tax (SALT) deduction on our community. Participants will include members of our local Realtor associations, San Diego Taxpayer Advocate Service, and representatives from our local Taxpayer Associations. Viewing space is limited.

The Internal Revenue Service today launched the new Tax Withholding Estimator, an expanded, mobile-friendly online tool designed to make it easier for everyone to have the right amount of tax withheld during the year.

Leaders from the IRS, state tax agencies and the tax industry today called on tax professionals nationwide to take time this summer to review their current security practices, enhance safeguards where necessary and take steps to protect their businesses from global cybercriminal syndicates prowling the Internet.

Are you considering adding any employees or making investment into your business within the next five years? If so, you may want to look into the California Competes Tax Credit to save money on your state income taxes. The next application round opens on July 29 and closes August 19.

Leaders from the IRS, state tax agencies and the tax industry today called on tax professionals nationwide to take time this summer to review their current security practices, enhance safeguards where necessary and take steps to protect their businesses from global cybercriminal syndicates prowling the Internet.

Business owners who file payroll and employment taxes using paper forms should consider filing these electronically. Here are some of the forms employers can e-file:

Small business owners should keep good records. This applies to all businesses, whether they have a couple dozen employees or just a few. Whether they install software or make soft-serve. Whether they cut hair or cut lawns. Keeping good records is an important part of running a successful business.

During Small Business Week, IRS urges businesses to make estimated tax payments so they don’t owe6/14/2019

As part of Small Business Week, the Internal Revenue Service today reminds small business owners and self-employed people that they can avoid a surprise tax bill and possibly a penalty by making estimated tax payments during the year.

Businesses that use a car or other vehicle may be able to deduct the expense of operating that vehicle on their taxes. Businesses generally can use one of the two methods to figure their deductible vehicle expenses:

Small business owners should keep good records. This applies to all businesses, whether they have a couple dozen employees or just a few. Whether they install software or make soft-serve. Whether they cut hair or cut lawns. Keeping good records is an important part of running a successful business.

WASHINGTON —During Small Business Week, the Internal Revenue Service is highlighting tax reform changes that impact depreciation and expensing for nearly every business. In some cases, these changes allow small business owners and the self-employed to write off the cost of machinery, equipment and other property more quickly.

WASHINGTON — During Small Business Week, the Internal Revenue Service reminds small business owners and self-employed individuals to take deductions and credits that will help their bottom line.

During Small Business Week, IRS spotlights expanded tax benefits for depreciation and expensing5/9/2019

WASHINGTON —During Small Business Week, the Internal Revenue Service is highlighting tax reform changes that impact depreciation and expensing for nearly every business. In some cases, these changes allow small business owners and the self-employed to write off the cost of machinery, equipment and other property more quickly.

The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local tax (SALT) deduction is in effect.

The Internal Revenue Service today urged taxpayers to file an accurate tax return on time, even if they owe but can’t pay in full. The IRS also recommends that taxpayers do a Paycheck Checkup early in 2019 to avoid having too much or too little tax withheld.

The Internal Revenue Service today provided additional expanded penalty relief to taxpayers whose 2018 federal income tax withholding and estimated tax payments fell short of their total tax liability for the year.

The Internal Revenue Service today urged taxpayers to protect the security of their personal, financial and tax information. Con artists use scams and schemes to steal personal information and money from unsuspecting victims, particularly during tax time.

The Internal Revenue Service today warned the public about a new twist on the IRS impersonation phone scam whereby criminals fake calls from the Taxpayer Advocate Service (TAS), an independent organization within the IRS.

|

news Categories

All

RECENT NEWS

July 2024

|

|

|

|

|

RSS Feed

RSS Feed